The 2026 Market Reset at a Glance

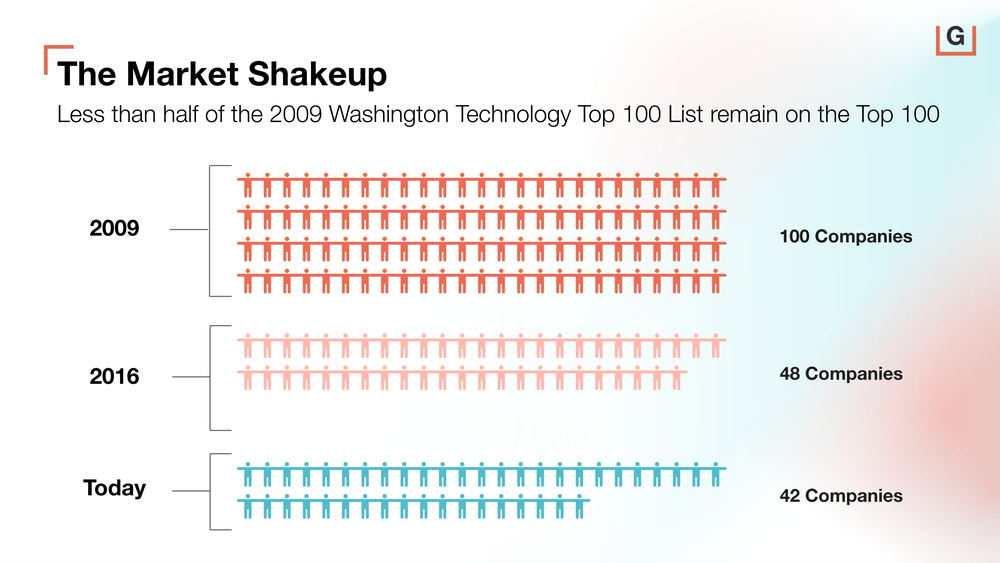

- The shutdown revealed a market already in transition.

- 2026 brings faster decision cycles, higher expectations, and fiercer competition.

- Contractor advantage now depends on speed, senior access, mission alignment, and provable impact.

- Mission-critical priorities are intensifying across cyber, AI, autonomy, CX, space, munitions, and SLG modernization.

- Decision authority has consolidated with fewer leaders making faster, higher-stakes calls.

- Defense and global markets are accelerating more quickly than the domestic federal market.

- SLG remains a stable, innovation-forward market.

- Contractors who move boldly in the next six months will define the next decade.

The longest funding lapse in history didn’t break the government market. Instead, it stripped away any lingering ambiguity about where things are heading.

As agencies restart, clear backlogs, and reestablish priorities, a new dynamic has emerged: one that divides the market into companies that adapt and those that fall behind.

At GovExec’s annual Market Preview, CEO Tim Hartman, Editor-in-Chief Frank Konkel, and Defense One's Science & Technology Editor Patrick Tucker unpacked the reset. What they described was far beyond a temporary disruption.

This structural realignment was already underway well before the shutdown.

1. The market had reset long before the shutdown made it obvious.

The most significant change heading into 2026 is the narrowing of distance between mission owners and solution providers. The mechanics of government buying had fundamentally changed prior to the shutdown. Agencies have already reoriented how they identify problems, evaluate technology, and engage with industry.

The new engagement model is:

- More direct (fewer intermediaries)

Agencies are reducing layers between themselves and solution providers.

- More accelerated (shorter cycles)

Engaging in faster, more direct conversations.

- More selective (higher expectations for mission relevance)

Reassessing and scrutinizing legacy partnerships.

Decision-makers have changed, and so, too, has what they value: speed, clarity, mission relevance, and demonstrable impact.

Your Top Takeaway: Access and influence (not incumbency) drive opportunity.

2. What are the urgent mission priorities?

Mission-critical areas are racing forward, while legacy programs are being reevaluated under closer scrutiny.

Agencies have returned to work with heightened urgency around:

- Modernization at scale: AI, automation, and low-lift modernization tools

- Cyber resilience: Zero trust maturity, identity + credentialing

- Mission systems: Real-time data, sensing, autonomous decision support

- CX-driven operations: Especially after delivery delays during the shutdown

- Space and air defense: Golden Dome is the golden child

What’s slowing or consolidating?

- Long-tail modernization without clear ROI

- Multi-layered vendor ecosystems

- Legacy IT modernization with unclear mission impact or measurable outcomes

Your Top Takeaway: 2026 is a year of intensified urgency, especially where mission and modernization converge.

3. How are agencies buying differently, and who gains from it?

The shutdown forced agencies to work through new backlogs with less time, fewer staff, and greater pressure. When combined with ongoing acquisition reforms, the result is a procurement environment where agencies are:

- Launching pilots earlier

- Engaging vendors more directly

- Compressing buying cycles

- Favoring mission-ready solutions

This new path to market favors clarity, speed, and proof, and disadvantages vendors still clinging to long capture cycles, compliance-only proof points, or generalist messaging.

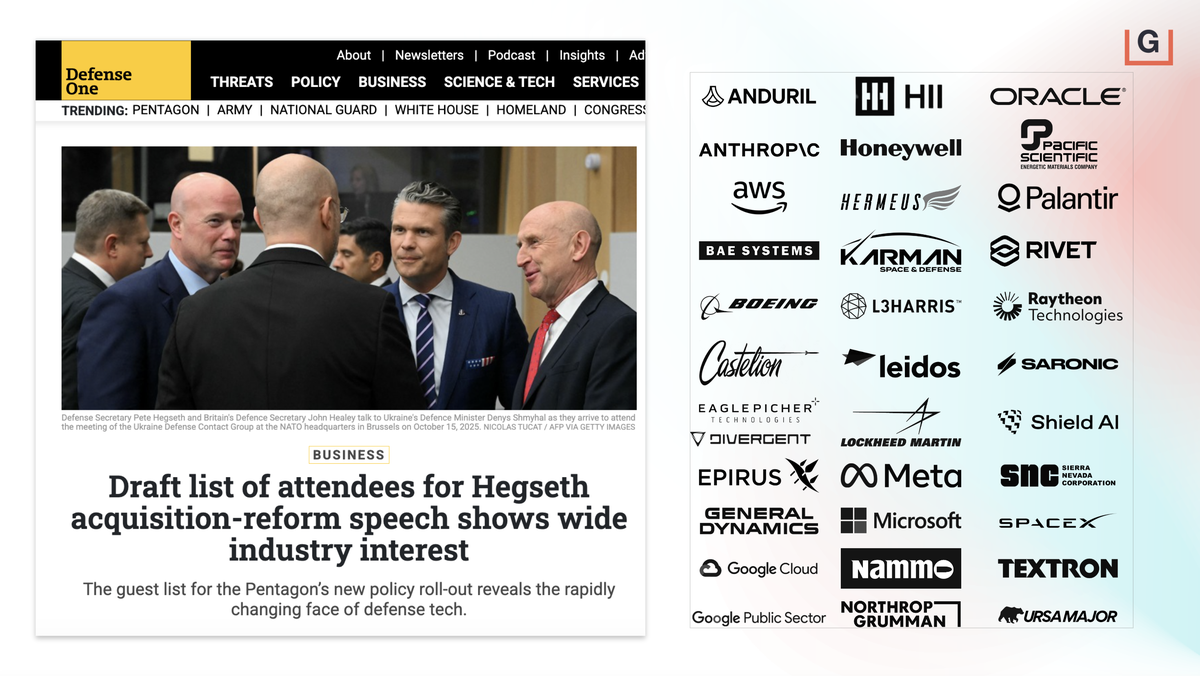

Who gains:

- AI-native companies

- Commercial tech entering the government market for the first time

- Agile defense startups

- Vendors who can prove impact immediately

Who risks losing relevance:

- Companies selling capabilities instead of outcomes

- Firms with slow legal and compliance review processes

- Legacy companies without proof-of-impact storytelling

- Vendors relying solely on compliance and incumbency