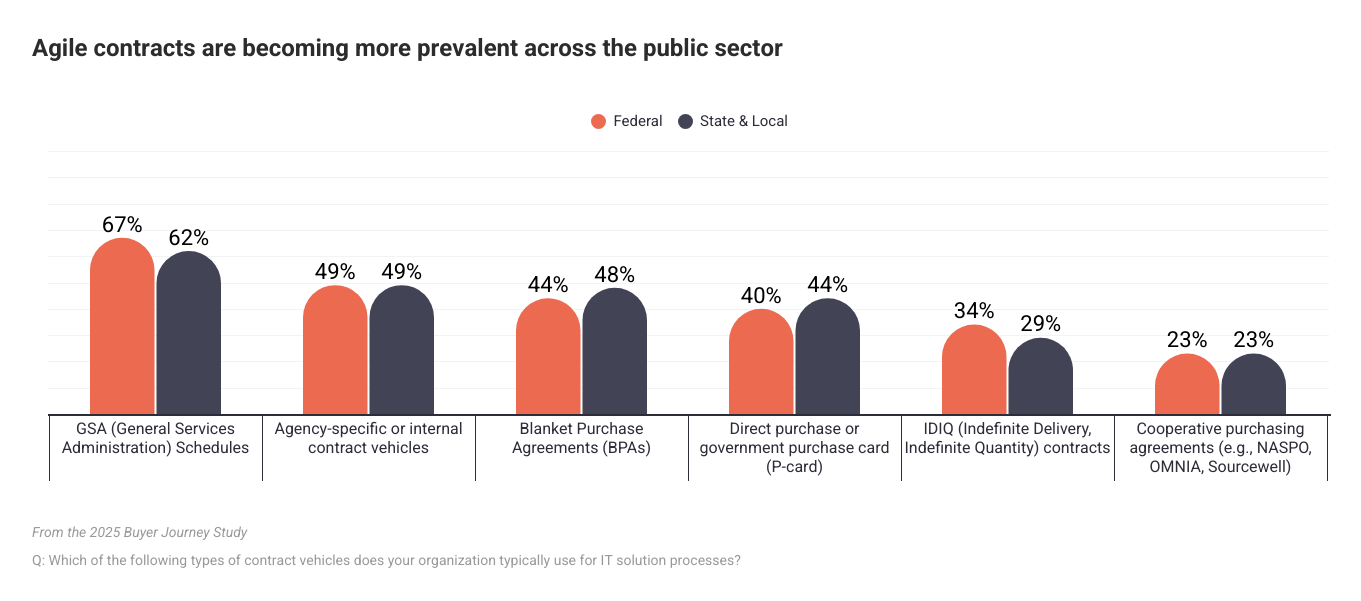

Federal procurement is consolidating quickly, and for B2G marketing and BD leaders, the center of gravity is decisively migrating toward GSA. By the end of the year, GSA is expected to control roughly half of all federal procurement dollars, fundamentally changing how contractors go to market with government buyers.

If your growth strategy still treats “the agency” as the center of the universe, it’s time for an update.

If that made you feel mildly stressed… take a deep breath.

What is Procurement Consolidation?

Procurement consolidation is the federal push to centralize common purchasing so agencies buy more “everyday” goods and services through standardized, governmentwide channels rather than duplicating contracts across departments.

In practice, it means:

- More spend routes through GSA-managed vehicles for common categories.

- More “use what already exists” behavior before a new competition gets approved.

- More influence from category management and enterprise-wide buying strategy.

GSA as the New Power Buyer

The federal government’s “common goods and services” spend is on the order of hundreds of billions annually, and only a fraction currently flows through GSA vehicles. The policy direction is designed to increase that share significantly.

Translation: GSA pathways become the front door more often.

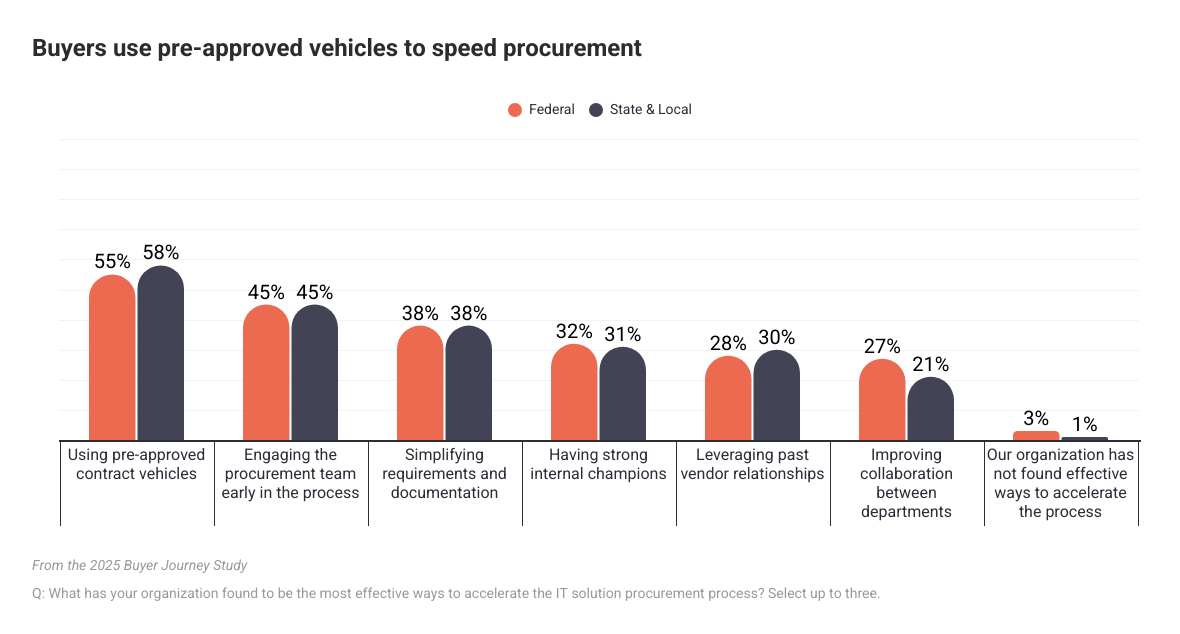

As GSA consolidates acquisition authority, more spend will flow through a smaller number of enterprise‑wide, pre‑competed vehicles and Best‑in‑Class contracts. This creates higher‑value, higher‑visibility platforms, but also higher barriers to entry for vendors that are not well-positioned on those vehicles.

So for BD teams, “Which agencies are we targeting?” still matters, and “Which GSA vehicles are we positioned on?” becomes equally strategic.

With GSA steering close to $500 billion in annual obligations, category management and portfolio‑level decision making will matter more than individual program office relationships. Contractors that can show how their offerings fit into GSA’s government‑wide strategies (rather than just one agency’s needs) will have an edge.